tl;dr

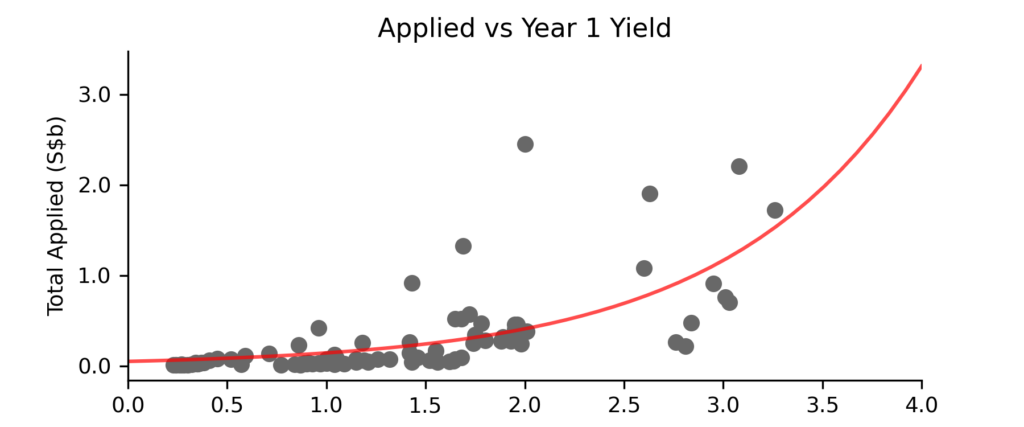

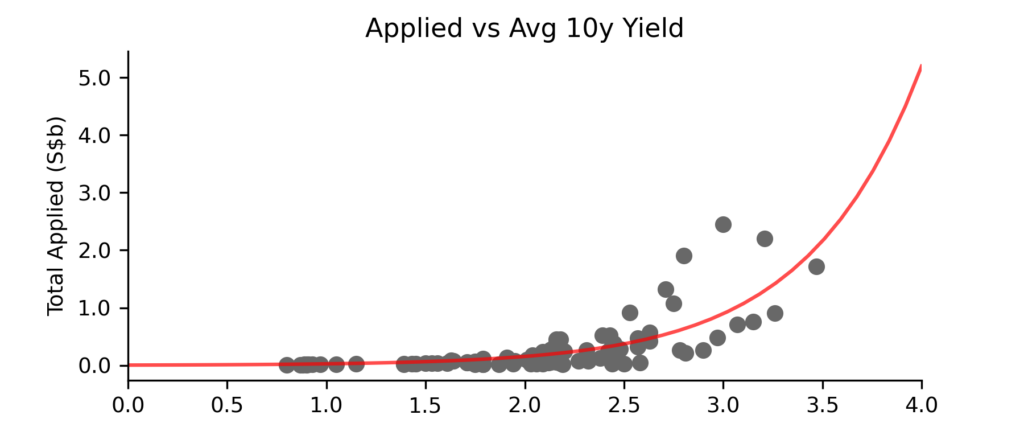

Wisdom from the masses: people wake up and get attracted to SSB when

- Year 1 yield > 1.8%, and

- Average 10-year yield > 2.5%

What is it good for?

- Good substitute for Fixed Deposits, with the option to lock in the rate for 10 years

- Savings that you do not need for at least 1-month

What are Singapore Savings Bonds (SSB)?

Singapore Savings Bond is an investment product only offered to individual investors as an additional asset class to complement your other savings and investments as a safe way to save for the future.

Principal Guaranteed: SSBs are fully backed by the Singapore Government, it is principal guaranteed and you can always get your investment amount back in full with no capital loss.

No lock-in: You can choose to redeem your SSBs in any given month with no penalties. You would be paid a pro-rated amount of interest based on the month of redemption, and the applicable interest rate for the SSB for that particular year. If a subsequent SSB offers higher interest rate, you can always redeem the past SSB you already have, and subscribe to the new SSB. This makes SSB a better substitute for Fixed Deposit offered by banks, with a maximum 1-month lead time for an early redemption.

Long-term: SSBs are by default issued with a 10-year tenor. In general, the longer you stay invested in it, the more interest you earn as the interest increases each year.

How do I invest in SSB?

You would have to be an individual aged 18 years and above, have an individual CDP Securities account set up, and a bank account with one of the three local banks in Singapore.

You can apply for SSB through DBS/POSB, OCBC and UOB ATMs, or internet banking. OCBC is the only bank that allows application through their mobile banking app. There is a nominal service fee the bank would charge with each application and each redemption request.

Minimum subscription amount: SGD 500 (per application)

Maximum subscription amount: SGD 200,000 per individual (aggregated across all SSB holdings)

Which yields do SSB investors look at?

Looking at the historical SSB application volumes and yields, you could surmise that the average SSB investor only starts applying for SSB when the Year 1 yield exceeds 1.8%.

Doing a scan through the application volumes against the the other yields (year 2 to year 10, and average yields across the 10 years), it can be observed that the average 10-year yield being at least 2.5% also goes into the decision of when to apply for SSB.

The above hurdle rate seems rather low in light of where SGD interest rates are presently at since the rate hike cycle from March 2023 where the 6-month T-bills cut-off yield in June 2023 was~3.8%. However, this is likely a quirk of having an inverted yield curve, where the shorter tenor bonds have higher yields than the longer tenor bonds.